Industry is responsible for approximately 30 percent of total global carbon dioxide emissions. More than half of these emissions come from industries that are hard-to-abate due to high-temperature and high-pressure processes that are difficult to economically electrify or decarbonize through other carbon-free methods. These industries are also characterized by large investments in facilities and equipment with decades of useful life, slow turnover of that capital stock, and low economic margins.

Carbon capture is a significant part of the solution to decarbonizing these industries. Over $12 billion from the Bipartisan Infrastructure Law has been allocated for carbon management including integrated commercial-scale carbon capture, transport, and storage demonstrations; large-scale carbon capture pilots; and the buildout of regional carbon dioxide transport and storage hubs.

On January 29, 2024, the U.S. Department of Energy’s (DOE) Office of Fossil Energy and Carbon Management released a Request for Information: Industrial Deployment and Demonstration Opportunities for Carbon Capture Technologies that closes on April 1, 2024. Through the request for information, the Office of Fossil Energy and Carbon Management seeks input from key partners (domestic and international) on what is needed to accelerate deployment of carbon capture, use, and storage for industrial systems to support the energy transition, eliminate greenhouse gas emissions, produce clean energy, create well-paying union jobs, and enable a net-zero carbon emissions economy by 2050, all while prioritizing environmental equity and support for underserved communities. The information being sought is intended to assist DOE in the planning of priorities and initiatives to catalyze the development, demonstration, and deployment of carbon capture, utilization, and storage for industrial decarbonization.

The request for information is focused on 11 industries: petrochemical, ammonia, aluminum, iron-steel, refining, soda ash, lime, pulp and paper, cement, glass, and LNG, with carbon dioxide equivalent emissions of 479 million tonnes/year in the United States and 9,487 million tonnes per year globally (Table 1). Carbon dioxide equivalent is used to measure and compare emissions from greenhouse gases.

Table 1. Annual US and Global Scope 1 CO₂e Emissions for Specific Industrial Sectors

| Industrial Sector | Annual US Scope 1 CO₂e Emissions (million tonnes/year) [1] [% of total Scope 1 industrial emissions] | Annual Global Scope 1 CO₂e Emissions (million tonnes/year) |

|---|---|---|

| Aluminum | 2.9 [< 1] | 270.0[2] |

| Ammonia | 34.0 [4] | 500.0[3] |

| Cement | 69.0 [7] | 2420.0[5] |

| Glass | 7.8 [1] | 95.0[4] |

| Iron-Steel | 66.0 [7] | 2620.0[5] |

| Lime | 27.0 [3] | 494.5[5] |

| Petrochemicals | 63.0 [7] | 1330.0[5] |

| Paper | 25.0 [3] | 150.0[5] |

| Refining | 165.0 [17] | 1590.0[6] |

| Soda Ash | 5.3 [< 1] | 17.4[7] |

| LNG | 14.0 [1] | Unknown |

| Total for the Sectors Noted | 479.0 | 9487.0 |

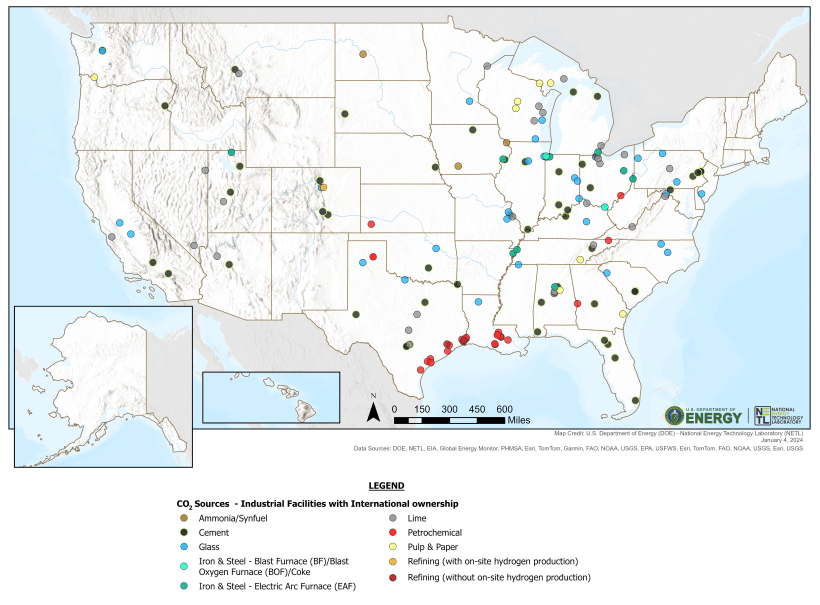

Multiple business models are being explored in these industries to improve the economics of industrial carbon capture and storage. These business models consider the proximity to storage sites and the potential of sharing of carbon transport and storage infrastructure with nearby facilities. A recent paper from Princeton University, “Shared CO₂ capture, transport, and storage for decarbonizing industrial clusters” found that when carbon dioxide pipelines are shared rather than dedicated to individual capture facilities, average transport costs can be reduced by two-thirds. The paper also analyzed how pooling emissions streams from facilities with different concentrations of carbon dioxide to a central capture site would reduce costs even further.[8] To support region-specific responses and identification of collaboration opportunities, Figure 1 shows industrial facilities in the United States along with locations of potential storage sites and FECM projects.

An aspect of carbon capture, use, and storage for industrial purposes is the global multiplier potential of domestic deployment of the technology here in the United States. Although U.S. emissions represent ~5% of global carbon dioxide emissions in these industries, many international companies have facilities in the United States (Table 1). Nearly 30 percent of industrial plants in the United States, including petrochemical, ammonia, aluminum, iron and steel, refining, soda and ash, lime, and pulp and paper, and more than 50 percent of cement and glass facilities, have an international parent company (Figure 2). These companies have facilities all over the world and can deploy the technology developed for their U.S. operations at their facilities in other countries.

The most compelling financial incentive for industry to implement carbon capture and storage is the 45Q tax credit. The 45Q tax credit pays up to $85 per ton of carbon dioxide stored; requires that qualified projects commence construction by the end of 2032; and allows the taxpayer to claim the credit for 12 years once a project is placed in service. However, for some industries, the 45Q tax credit will not be enough to make carbon capture and storage economic for many individual facilities. Other funding mechanisms such as federal loan guarantees, grants, and state or local incentives are likely to be required. Additionally, synergies in sharing infrastructure and workforce with other carbon management projects in regions and clusters to reduce investment and operating costs, access to technical expertise through the U.S. national laboratories to support deployment, and the opportunity to deploy technologies and best practices to facilities in other markets will also improve the business case.

The request for information is an important opportunity for key domestic and international partners to contribute to potential new areas of focus and innovation; identify challenges and knowledge gaps; identify funding opportunities; identify regional opportunities; and determine the potential for clean energy and carbon management careers.

[1] EPA Flight Data (2021)

[2]https://www.iea.org/energy-system/industry

[3] https://royalsociety.org/-/media/policy/projects/green-ammonia/green-ammonia-policy-briefing.pdf

[5] https://pubs.usgs.gov/periodicals/mcs2022/mcs2022-lime.pdf

[6] https://www.sciencedirect.com/science/article/pii/S2666675822001576

[7] https://www.statista.com/statistics/1013480/sodium-carbonate-production-worldwide-by-type/

[8] Shared CO₂ capture, transport, and storage for decarbonizing industrial clusters - ScienceDirect