U.S. States Ranked by the Value of their Mineral Production

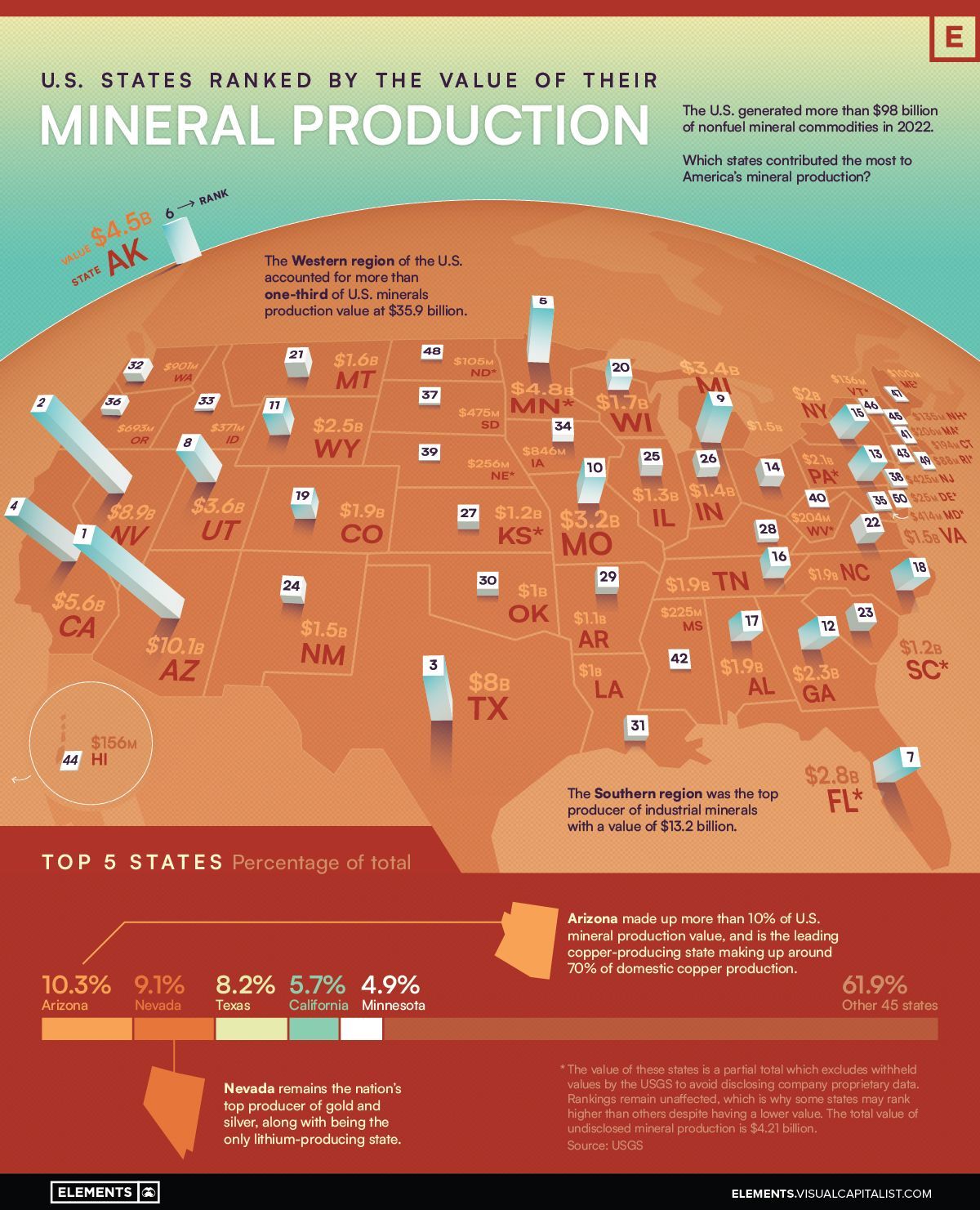

The U.S. produced $98.2 billion worth of nonfuel minerals in 2022, but which states made up the majority of the mining?

This map uses data from the USGS to map and rank U.S. states by the value of their nonfuel mineral production in 2022.

The ranking takes into account the mining of nonfuel minerals that are split into two main categories: metallic minerals (like gold, copper, or silver), and industrial minerals (like phosphate rock, various types of clay, and crushed stone).

The Top Mineral-Producing States in the U.S.

Arizona tops the list of mineral-producing states, with $10.1 billion worth of minerals which account for 10.3% of the U.S. total, largely due to the state’s prolific copper production. The state of Arizona accounted for around 70% of domestic copper production in 2022, and as a result also produces large amounts of molybdenum as a byproduct.

The state of Nevada was the next top mineral producer at $8.9 billion worth of minerals, thanks to its longstanding leadership in gold mining (accounting for 72% of U.S. gold production in 2022) and by having the only operating lithium project in America.

States in the Western region of the U.S. dominate the ranking of top mineral-producing states, holding the top two spots and making up half of the top 10 when it comes to total mineral production value.

| Rank | State | Mineral Production Value (2022) | Share of U.S. total |

|---|---|---|---|

| 1 | Arizona | $10.1B | 10.3% |

| 2 | Nevada | $8.9B | 9.1% |

| 3 | Texas | $8.0B | 8.2% |

| 4 | California | $5.6B | 5.7% |

| 5 | Minnesota* | $4.8B | 4.9% |

| 6 | Alaska | $4.5B | 4.6% |

| 7 | Florida* | $2.8B | 2.9% |

| 8 | Utah | $3.6B | 3.7% |

| 9 | Michigan | $3.4B | 3.4% |

| 10 | Missouri | $3.2B | 3.2% |

*The value of these states is a partial total which excludes withheld values by the USGS to avoid disclosing company proprietary data. Rankings remain unaffected which is why some states may rank higher than others despite having a lower value.

Texas rounds out the top three at $8 billion worth of minerals produced in 2022, largely thanks to its dominant production of crushed stone. The state of Texas was the top producer of crushed stone in 2022 at more than $2.8 billion worth, nearly double that of the next largest producer, Florida, which produced $1.5 billion worth.

What Minerals is the U.S. Producing the Most of?

Nonfuel mineral production is categorized into two main categories by the USGS, metals/metallic minerals and industrial minerals.

While not as shiny, the produced value of industrial minerals far outweighs that of metallic minerals. While $34.7 billion worth of metals were produced in 2022, industrial mineral production value was nearly double at $63.5 billion.

Construction aggregates like construction sand and gravel along with crushed stone made up almost half of industrial minerals production at $31.4 billion, with crushed stone being the leading mineral commodity overall at $21 billion of production value.

Following crushed stone, the next top minerals produced but the U.S. were (in decreasing order of value): cement, copper, construction sand and gravel, and gold.

Although the value of metals production decreased by 6% compared to 2021, industrial minerals production increased by 10% year-over-year, resulting in an overall increase in America’s overall nonfuel mineral production of 4%.

Copyright © 2023 Visual Capitalist