By Tessa Di Grandi Article & Editing Bruno Venditti Graphics & Design Alejandra Dander

The Future Demand For Battery Minerals

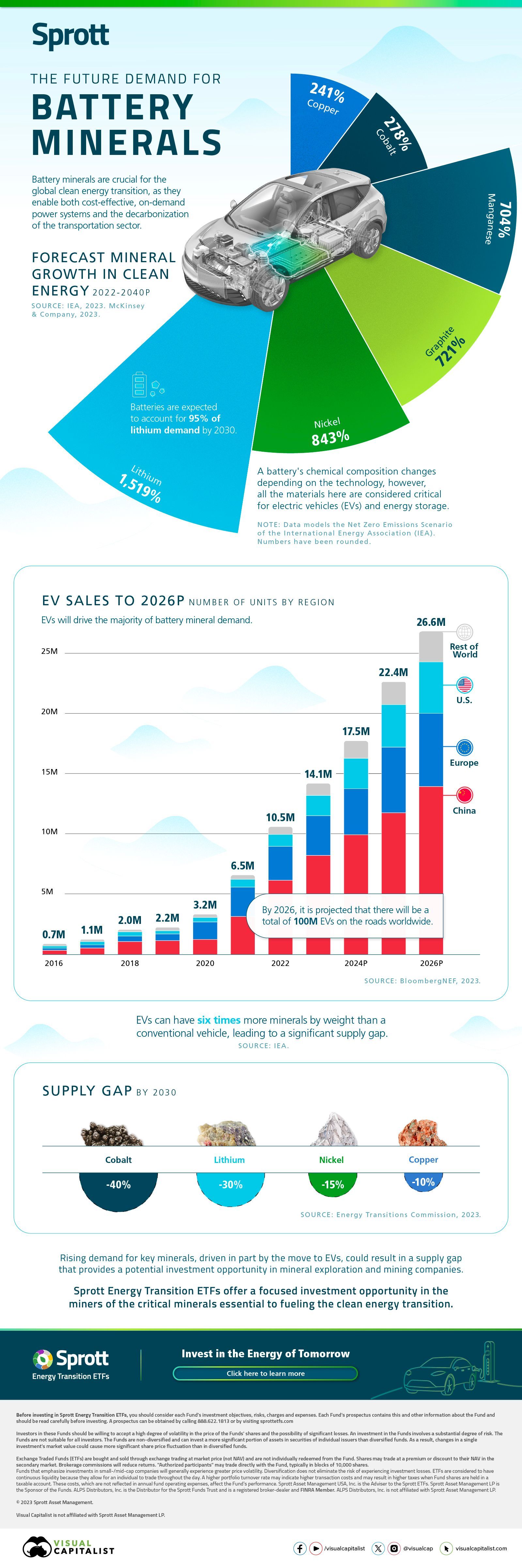

Battery minerals are vital for the clean energy transition. They power cost-effective, on-demand energy systems and are at the core of decarbonizing transportation.

In this graphic, our sponsor Sprott examines the growth in demand for battery metals, as well as potential supply constraints.

Exploring Mineral Growth to 2040

Demand for battery metals is set to skyrocket in the coming years. Let’s break down the expected growth between current usage and the projected demand in 2040, based on a Net Zero Emissions Scenario (NZE):

| Mineral Demand (kilotonnes) | 2022 | 2040P (NZE) |

|---|---|---|

| Copper | 6,062.6 kt | 20,677.8 kt |

| Cobalt | 68.3 kt | 258.5 kt |

| Lithium | 73.3 kt | 1,187.5 kt |

| Nickel | 460.6 kt | 4,344.8 kt |

| Graphite | 552.8 kt | 4,540.4 kt |

| Manganese | 187.4 kt | 1,507.3 kt |

The raw materials that batteries use can differ depending on their chemical compositions. However, these metals are considered critical for EVs and energy storage.

For example, the cells in the average battery with a 60 kilowatt-hour (kWh) capacity—the same size that’s used in a Chevy Bolt—contained roughly 185 kilograms of minerals.

Supply Gap in 2030

The growing demand for these battery metals is raising concerns over supply. Predicted shortages are expected to emerge by or before 2030, according to Energy Transitions Commission:

| Mineral | Supply gap in 2030P |

|---|---|

| Copper | -10% |

| Nickel | -15% |

| Lithium | -30% |

| Cobalt | -40% |

The rising demand for key minerals, driven in part by the move to EVs, could result in a supply gap that provides a potential investment opportunity in mineral exploration and mining companies.

Copyright © 2024 Visual Capitalist