By Sponsored Content Article/Editing: Bruno Venditti

Visualizing the Demand for Battery Raw Materials

Metals play a pivotal role in the energy transition, as EVs and energy storage systems rely on batteries, which, in turn, require metals.

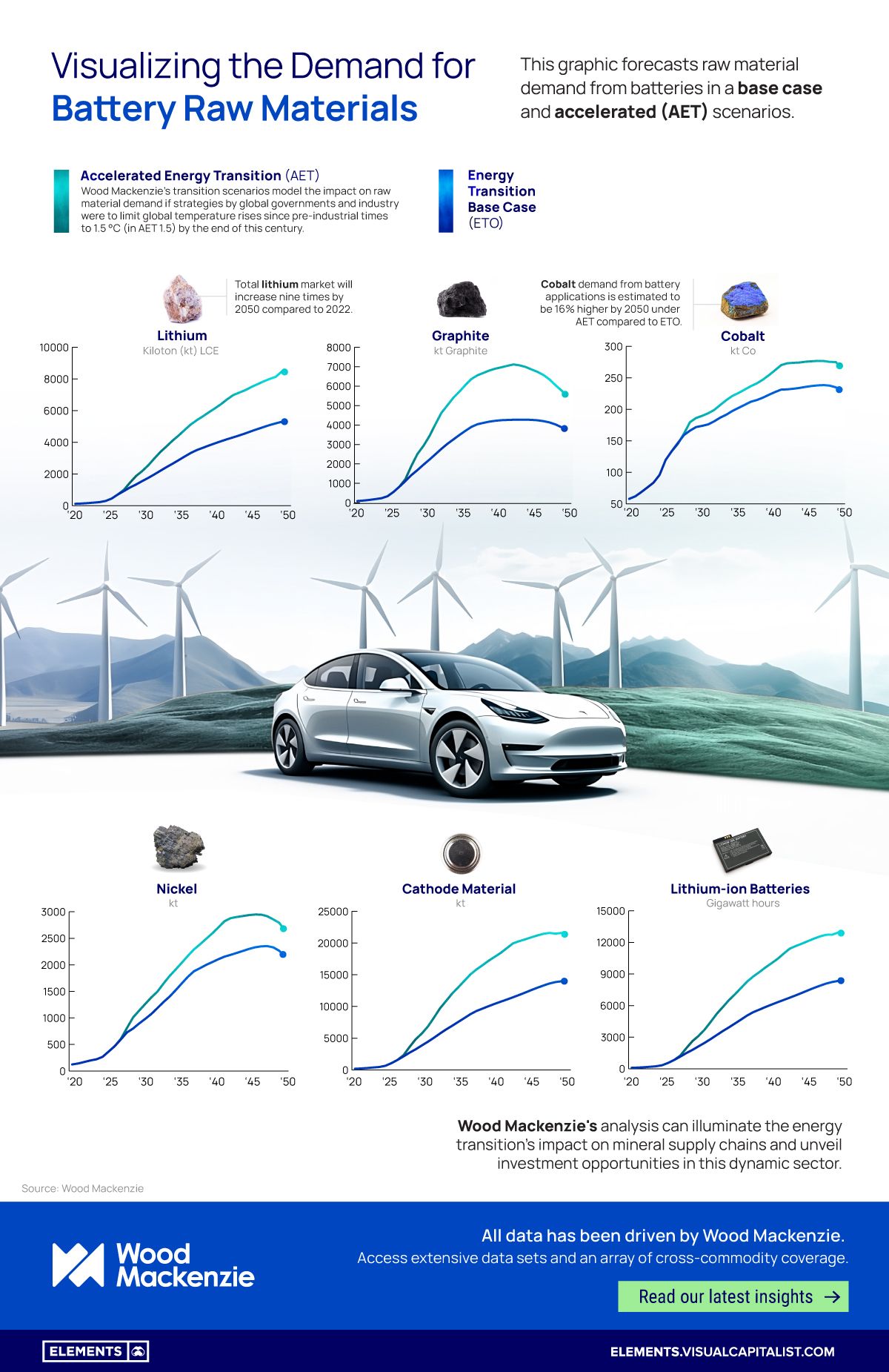

This graphic, sponsored by Wood Mackenzie, forecasts raw material demand from batteries. It presents a base case scenario that incorporates the evolution of current policies, indicating a global temperature rise of 2.5°C by 2100. Additionally, it explores an accelerated (AET) scenario, where the world aims to limit the rise in global temperatures to 1.5°C by the end of this century.

Growing Demand for Metals in an Accelerated Scenario

Lithium is a crucial material in high-energy-density rechargeable lithium-ion batteries.

The lithium fueling electric vehicle batteries undergoes refinement from compounds sourced in salt-brine pools or hard rock and quantities are measured in terms of lithium carbonate equivalent (LCE).

According to Wood Mackenzie, by 2030, the demand for LCE is expected to be 55% higher in an AET scenario compared to the base case, and 59% higher by 2050.

| Base Case | Unit | 2023 | 2030 | 2050 |

|---|---|---|---|---|

| Battery demand (Li-ion and Na-ion) | GWh | 1,152 | 3,577 | 8,395 |

| Cathode active material (Li-ion and Na-ion) | kt | 2,132 | 6,376 | 13,995 |

| Lithium | kt LCE | 878 | 2,390 | 5,275 |

| Nickel | kt | 596 | 1,299 | 2,151 |

| Cobalt | kt | 147 | 187 | 228 |

| Manganese | kt | 207 | 687 | 1,491 |

| Graphite | kt | 1,119 | 3,034 | 3,748 |

| AET | Unit | 2023 | 2030 | 2050 |

|---|---|---|---|---|

| Battery demand (Li-ion and Na-ion) | GWh | 1,250 | 5,856 | 12,819 |

| Cathode active material (Li-ion and Na-ion) | kt | 2,326 | 10,865 | 21,149 |

| Lithium | kt LCE | 954 | 3,701 | 8,384 |

| Nickel | kt | 606 | 1,648 | 2,629 |

| Cobalt | kt | 145 | 207 | 265 |

| Manganese | kt | 225 | 1,124 | 2,163 |

| Graphite | kt | 1,220 | 5,018 | 5,461 |

The demand for two other essential metals in battery production, cobalt and nickel, is expected to be 16% and 22% higher, respectively, in 2050 in the AET scenario compared to the base case.

Given that graphite is the primary anode material for an EV battery, it also represents the largest component by weight in the average EV. The demand for graphite in an AET scenario is anticipated to be 46% higher than in a base case scenario.

Battery Materials Supply Chain

According to Wood Mackenzie data, an accelerated energy transition would require much more capital within a short timeframe for developing the battery raw materials supply chain – from mines through to refineries and cell production facilities.

Increased participation from Original Equipment Manufacturers (OEMs) will be necessary, risking EV sales penetration rates remaining below 15% in the medium term, in contrast to approximately 40% in the total market under an AET scenario.

In addition, finding alternative sources of metals, including using secondary supply through recycling, is another option available to the industry.

However, as noted in Wood Mackenzie’s research, current EV sales are too low to generate a sufficiently large scrap pool to create any meaningful new source of supply by 2030.

Access insights on the entire battery industry supply chain with Electric Vehicle & Battery Supply Chain Service by Wood Mackenzie.

Copyright © 2023 Visual Capitalist