The Future of Global Coal Production Visualized

Coal is the world’s most affordable energy fuel, and as such, the world’s biggest commodity market for electricity generation.

Unfortunately, that low-cost energy comes at a high cost for the environment, with coal being the largest source of energy-related CO2 emissions.

Despite its large footprint, coal was in high demand in 2021. As economies reopened following the start of the COVID-19 pandemic, countries struggled to meet resurgent energy needs. As a readily available low-cost energy source, coal filled the supply gap, with global coal consumption increasing by 450 million tonnes or around +6% in 2021.

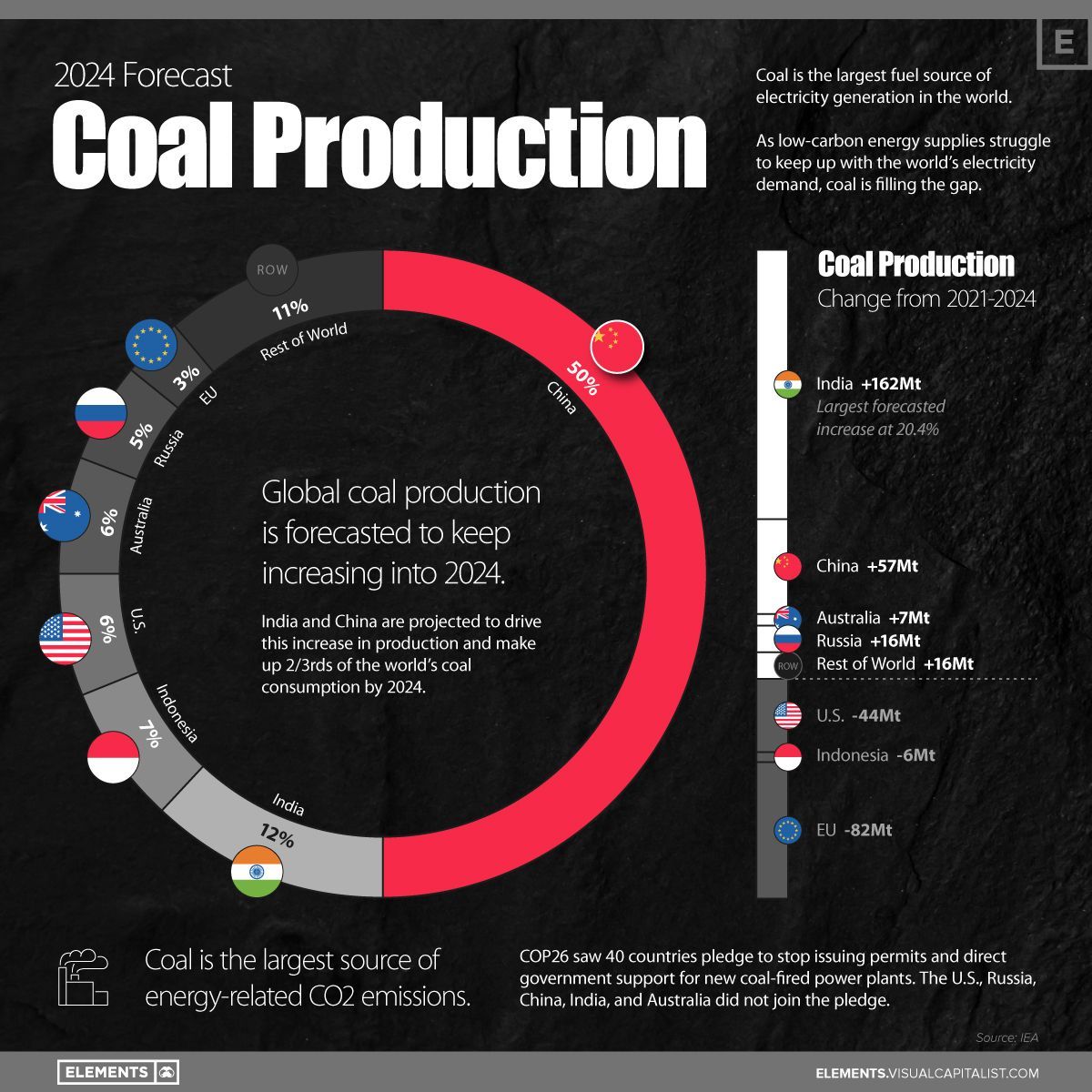

This graphic looks at the IEA’s coal production forecasts for 2024, and the specific countries projected to reduce or increase their production over the next few years.

Which Countries Are Increasing (or Reducing) Coal Production?

Global coal production was a topic of scrutiny at the COP26 conference held in November of 2021, where 40 countries pledged to stop issuing permits and direct government support for new coal-fired power plants.

However, many of the top coal-producing countries did not commit to the pledge. China, the U.S., India, Russia, and Australia abstained, and of those five, only the U.S. is forecasted to reduce coal production in the next two years.

| Country | Coal Production (2021) | Coal Production (2024F) | Share (2024F) | Change (2021–2024F) |

|---|---|---|---|---|

| 🇨🇳 China | 3,925 Mt | 3,982 Mt | 50% | +57 Mt |

| 🇮🇳 India | 793 Mt | 955 Mt | 12% | +162 Mt |

| 🇮🇩 Indonesia | 576 Mt | 570 Mt | 7% | -6 Mt |

| 🇺🇸 United States | 528 Mt | 484 Mt | 6% | -44 Mt |

| 🇦🇺 Australia | 470 Mt | 477 Mt | 6% | +7 Mt |

| 🇷🇺 Russia | 429 Mt | 445 Mt | 5% | +16 Mt |

| 🇪🇺 European Union | 329 Mt | 247 Mt | 3% | -82 Mt |

| 🌐 Other | 839 Mt | 855 Mt | 11% | +16 Mt |

Source: IEA

With 15 EU countries signing the pledge, the European Union is forecasted to see the greatest drop in coal production at 82 million tonnes, along with the greatest forecasted reduction in coal consumption (101 million tonnes, a 23% reduction).

Reducing Coal-Fired Power Generation in the U.S.

The U.S. and Indonesia are the other two major producers forecasted to reduce their reliance on coal. The U.S. is projected to cut coal production by 7.5% or 44 million tonnes, while Indonesia’s reduction is forecasted at 6 million tonnes, or just a 1% cut of its 2021 production.

Despite not joining the COP26 pledge, the U.S. is still noticeably pursuing short and long-term initiatives to reduce coal-fired power generation.

In fact, 85% of U.S. electric generating capacity retirements in 2022 are forecast to be coal-fired generators, and there are further plans to retire 28% (59 GW) of currently operational coal-fired capacity by 2035.

Coal Makes Energy Ends Meet in China and India

Modern consumption and production are instead focused in Asia.

China and India produce almost 60% of the world’s coal, and are expected to increase their production by more than 200 million tonnes per year, collectively. All this coal goes towards meeting the insatiable energy demands of both nations.

While China has pledged to start cutting down coal consumption in 2026, the country also announced the construction of 43 new coal-fired power plants to meet energy demand until then. Part of the additional production is driven by a need to reduce the country’s dependence on coal imports, which are expected to drop by 51 million tonnes or 16% from 2021–2024.

By 2024, China’s coal consumption is forecasted to rise by 3.3% and India’s by 12.2%, which would make the two countries responsible for two-thirds of the world’s coal consumption.

Copyright © 2024 Visual Capitalist