By Govind Bhutada Graphics/Design: Sam Parker

The Size of the Oil Market vs Top 10 Metal Markets

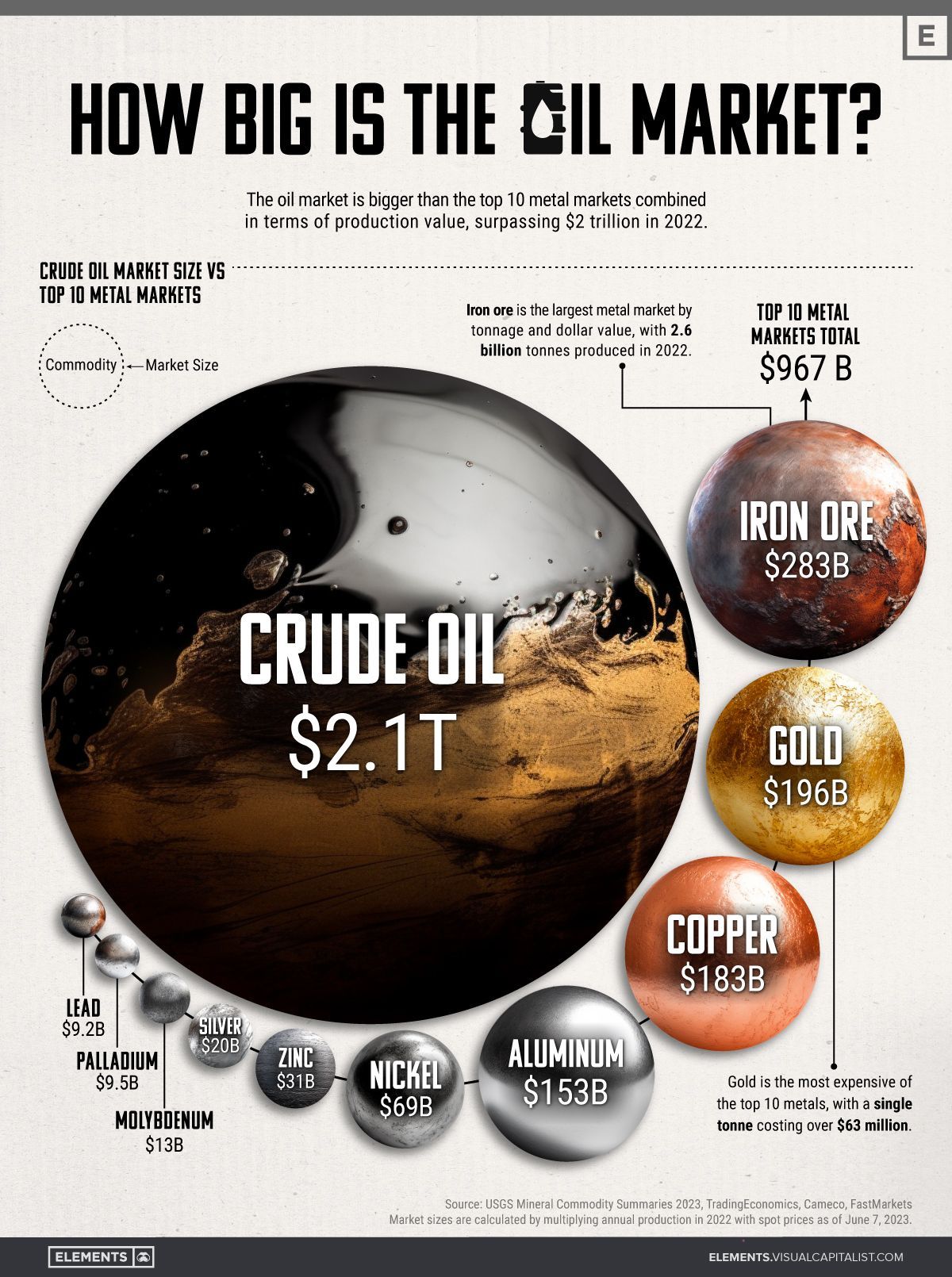

While the global economy relies on many commodities, none come close to the massive scale of the oil market.

Besides being the primary energy source for transportation, oil is a key raw material for numerous other industries like plastics, fertilizers, cosmetics, and medicine. As a result, the global physical oil market is astronomical in size and has a significant economic and geopolitical influence, with a few countries dominating global oil production.

The above infographic puts crude oil’s market size into perspective by comparing it to the 10 largest metal markets combined. To calculate market sizes, we used the latest price multiplied by global production in 2022, based on data from TradingEconomics and the United States Geological Survey (USGS).

Note: This analysis focuses on raw and physical materials, excluding derivative markets and alloy materials like steel.

How Big Is the Oil Market?

In 2022, the world produced an average of 80.75 million barrels of oil per day (including condensates). That puts annual crude oil production at around 29.5 billion barrels, with the market size exceeding $2 trillion at current prices.

That figure dwarfs the combined size of the 10 largest metal markets:

| Commodity | 2022 Annual Production | Market Size |

|---|---|---|

| Crude Oil | 29.5 billion barrels | $2.1 trillion |

| Iron Ore | 2.6 billion tonnes | $283.4 billion |

| Gold | 3,100 tonnes | $195.9 billion |

| Copper | 22 million tonnes | $183.3 billion |

| Aluminum | 69 million tonnes | $152.6 billion |

| Nickel | 3.3 million tonnes | $68.8 billion |

| Zinc | 13 million tonnes | $30.9 billion |

| Silver | 26,000 tonnes | $19.9 billion |

| Molybdenum | 250,000 tonnes | $12.9 billion |

| Palladium | 210 tonnes | $9.5 billion |

| Lead | 4.5 million tonnes | $9.2 billion |

Based on prices as of June 7, 2023.

The combined market size of the top 10 metal markets amounts to $967 billion, less than half that of the oil market. In fact, even if we added all the remaining smaller raw metal markets, the oil market would still be far bigger.

This also reflects the massive scale of global oil consumption annually, with the resource having a ubiquitous presence in our daily lives.

The Big Picture

While the oil market towers over metal markets, it’s important to recognize that this doesn’t downplay the importance of these commodities.

Metals form a critical building block of the global economy, playing a key role in infrastructure, energy technologies, and more. Meanwhile, precious metals like gold and silver serve as important stores of value.

As the world shifts towards a more sustainable future and away from fossil fuels, it’ll be interesting to see how the markets for oil and other commodities evolve.

Copyright © 2024 Visual Capitalist