Companies scrambling to increase supplies of critical materials are finding some luck in reopening sites

By Yusuf Khan and Mari Novik

Oct. 3, 2023 3:00 am ET | WSJ PRO

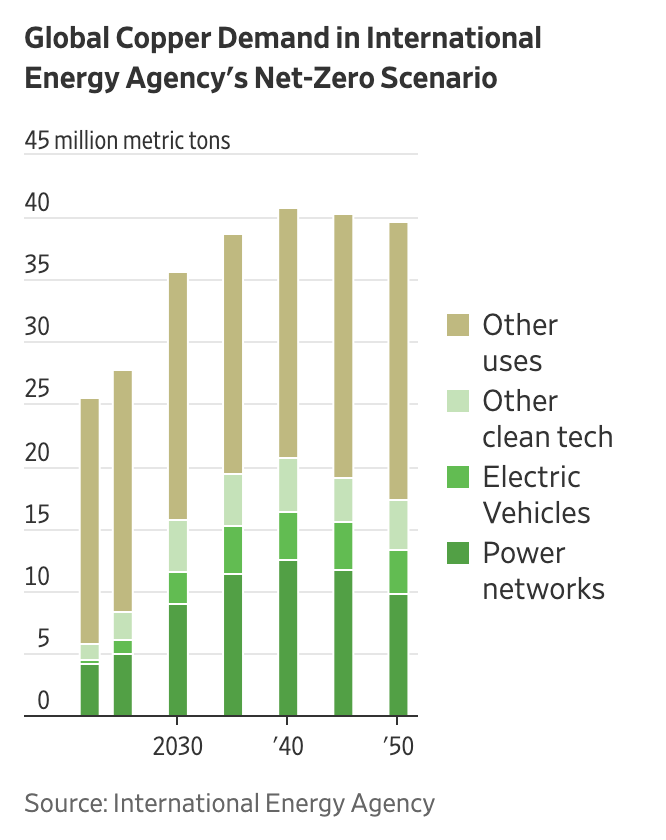

Billions of dollars are being poured into new mining projects across the globe as the energy transition drives a wave of exploration, but getting those new sites open is proving to be a challenge. In the U.S. and beyond, some are jumping ahead by targeting a new but also old source—closed mines, also known as brownfield sites.

In recent years, governments and companies have been bolstering critical-mineral projects to meet rising demand for batteries, electric vehicles, renewables and electrification infrastructure. But opening new mines takes years—particularly when faced with strong local opposition—and delays might hamper policy makers’ efforts to diversify these supply chains. Even with recent investment announcements, analysts are forecasting supply shortfalls.

For the 127 new mines opened globally between 2002 and 2023, it took an average of 15.7 years after discovery to get to commercial production, although actual figures ranged from six to 32 years, according to S&P Global Market Intelligence. While reopening closed mines can still be a challenge, in some cases the process can be quicker and easier because locals recall the economic benefits that doing so can bring and already have a pit just a few miles from their home.

One company aiming to do just that is Sweden-based miner Bluelake Mineral. In the mountains of northern Norway, Bluelake is seeking to reopen the Joma mine that closed 25 years ago because of low copper prices. Last month, the local municipality unanimously approved plans to reopen the copper and zinc mine.

Bluelake isn’t the only one; this trend can be seen around the globe. In the U.S., Perpetua Resources is working to launch a gold and antimony mining project in Idaho; Resolution Copper hopes to open an old site in Arizona; andMP Materials has revived a rare-earth site on the California-Nevada border. Projects have also been planned in Germany and Italy.

Bluelake’s plan to reopen the Joma site has been under way for just six years, and last month it received 11 out of 11 votes in favor of the zoning plan for the mine from Røyrvik’s local governing body—a surprising outcome even for the company. Under Norwegian law, the local approval was crucial for the reopening of the mine, Bluelake said. The mine is expected to operate for at least the next 20 years, according to the company.

Peter Hjorth, CEO of Bluelake, said one of the main reasons why his and many other brownfield mining projects are getting the green light is because they avoid damaging new land and work with local communities that have a memory of economic activity the industry can bring.

“The challenge [for us] has been permitting and also getting a social license for the project,” Hjorth said. As a brownfield project, Joma has an advantage because waste from the new mine, known as tailings, is going to be stored underground in used tunnels left from previous mining, avoiding the large dams involved in some notable disasters, he said.

Local memory of the former mine was also an important reason why the municipality chose to green light the copper mine, according to residents. “Røyrvik has a valued tradition of mining in the old times,” said Hans Oskar Devik, the leader of the local government. “The municipality’s population has been decreasing over a number of years and there are fewer and fewer jobs. It’s important to get a turnaround: New jobs, new people and their families.”

While the 426 people living in Røyrvik seem to support reopening the Joma mine, the wider region is home to the more nomadic Sami community who have concerns. “We are being pressed into a corner,” said Maahke Joma, chief of the Sami reindeer herders in Røyrvik. Joma—who shares his name with the mine—said that reopening it would shrink the reindeers’ calving area and could mean moving the herd elsewhere or culling the flock because their grazing lands are being reduced in size to accommodate the mine.

Joma said the voice of the Sami community wasn’t being heard during these talks and feared its culture was being ignored. “We are the losers in the big push towards a greener future,” he said.

Despite the challenges, brownfield mining is also being seen as a way to help ensure mineral security in the U.S., especially in areas such as defense and energy. Perpetua Resources plans to reopen a former gold rush mine in central Idaho, about a five-hour drive from Boise.

The company said it has had a lot of local buy-in partly because its plans also include cleaning up tailings waste from more than half a century ago that are leaching chemicals, such as arsenic, into the local river. Permitting has been a challenge because of this issue, the company said, but it recently received funding from the Defense Department, recognizing its importance as an American source of antimony, a mineral used widely in the defense industry.

“The shift we are seeing in the United States is a growing recognition that we must secure supply chains and a way to do that is bringing mining home and that means getting the public comfortable to bring mining home,” said McKinsey Lyon, VP of external affairs at Perpetua.

However, even with a potentially quicker permitting process, opening a brownfield mine remains costly. “The advantage of a brownfield is having a known site with a known ore body,” said James Litinsky, CEO of MP Materials. But he cautioned that they still remain “very capital intensive and difficult to operate.”

When MP bought its brownfield site in 2017, it had a mining permit but was in a state of disrepair, with the pit itself flooded. The previous owner of the site had invested $1.7 billion to reopen it but had gone bankrupt in 2015. MP then bought the mine and other assets two years later.

Litinsky invested $2 million initially to maintain the site’s mining permit while he drew up a plan and developed a business model. MP even presold material to generate cash for the years of work needed to make the site operational. “For the first couple of years, we were on the verge of bankruptcy every day,” Litinsky said. He estimates that more than $2 billion in total was invested to reopen the site.

Having mined over 10,000 metric tons of rare earth oxide last quarter, MP is also investing in refining facilities, to become the first in the U.S. Most rare-earth refining takes place in China, with only a handful of other sites currently operational globally.

Reopening brownfield mines is one way to more quickly expand and diversify global supplies of critical materials. Using land that has already been mined avoids destruction of a totally new area, according to Jeremy Richardson, research scientist and policy analyst at the Rocky Mountain Institute, a consulting firm that focuses on sustainability research.

Richardson agrees that a local memory of mining often makes it easier for companies to engage with the community but cautions early engagement is critical. “There are a lot of former industrial communities that are interested in [reopening] former sites…[but] it needs to be done in a responsible way,” he said.

Write to Yusuf Khan at yusuf.khan@wsj.com

Appeared in the October 5, 2023, print edition as 'Mining Old Sites Can Bring More Copper for Energy Transition'.

Copyright ©2023 Dow Jones & Company, Inc. All Rights Reserved.