By Govind Bhutada Graphics/Design: Rosey Eason

Lithium Consumption Has Nearly Quadrupled Since 2010

Lithium is well-known as one of the key materials behind the lithium-ion batteries that power electronic devices, electric vehicles, and energy storage technologies.

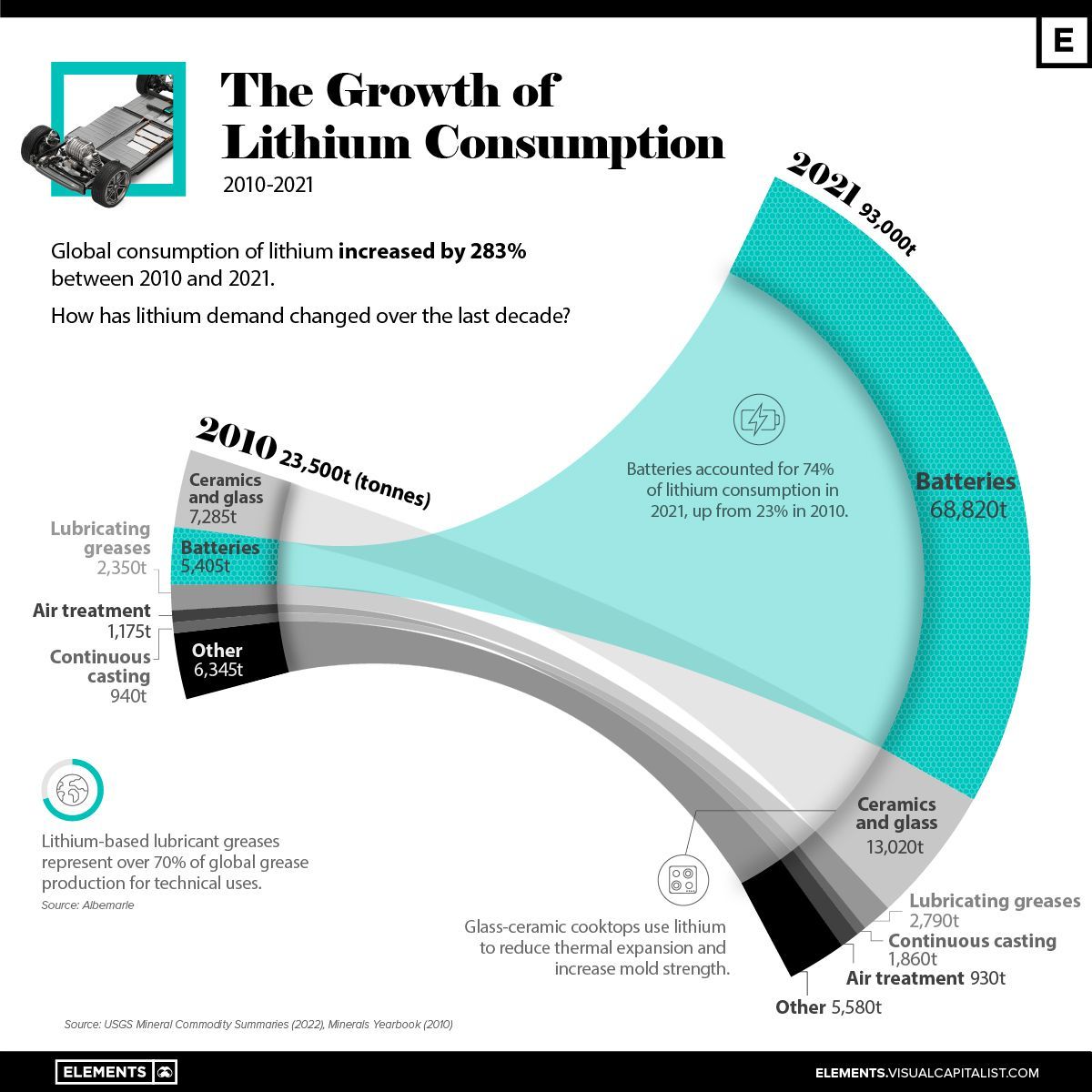

Because of its role in clean energy technologies, lithium demand hasn’t only increased, it has transformed. From primarily being used for ceramics, battery demand has taken over global lithium consumption and driven an almost four-fold increase since 2010.

The Impact of EV Batteries

Between 2000 and 2010, lithium consumption in batteries increased by 20% on average every year. In the following decade, that figure jumped to 107% per year for batteries, with overall lithium consumption growing 27% annually on average.

The full breakdown from the United States Geological Survey (USGS) shows the impact of battery consumption:

| End-use | Lithium Consumption 2010 (%) | Lithium Consumption 2021 (%) |

|---|---|---|

| Batteries | 23% | 74% |

| Ceramics and glass | 31% | 14% |

| Lubricating greases | 10% | 3% |

| Air treatment | 5% | 1% |

| Continuous casting | 4% | 2% |

| Other | 27% | 6% |

| Total | 100% | 100% |

Back in 2010, the single largest end-use of lithium was in ceramics and glass manufacturing. Adding lithium carbonate to the coatings on ceramics and glassware reduces their thermal expansion, which is often essential for modern glass-ceramic cooktops.

But over the course of the decade, the EV market grew rapidly, with the global market share of EVs surging from 0.01% in 2010 to 8.6% in 2021. This had a ripple effect on the demand for batteries, which now account for nearly three-fourths of worldwide lithium consumption.

Additionally, the lightweight metal also has other important applications that are less well-known. For instance, lithium-based lubricant greases represent over 70% of global grease production for technical uses. Additionally, it’s also used in die casting, color pigment creation, aluminum smelting, and gas and air treatment.

What’s Next for Lithium Consumption?

With mainstream EV adoption on the horizon, the 2020s could mark another decade of growing lithium consumption.

Multiple countries have pledged to phase out internal combustion engine (ICE) vehicles by 2030, and large automakers like Volkswagen, GM, and Ford plan on rolling out several new EV models.

As EV demand rises, it’s likely that lithium consumption—especially in batteries—will continue increasing, with batteries expected to use 84% of all lithium produced in 2025.

Copyright © 2024 Visual Capitalist