The gas is a critical component in scientific research, medical technology such as MRI scanners, national defense, airships, high-tech manufacturing and space exploration

A commodity by dictionary definition is something useful or valued, but here’s one irreplaceable raw material that is hard to transport, has many more uses than you might think, and is often overlooked by investors: helium.

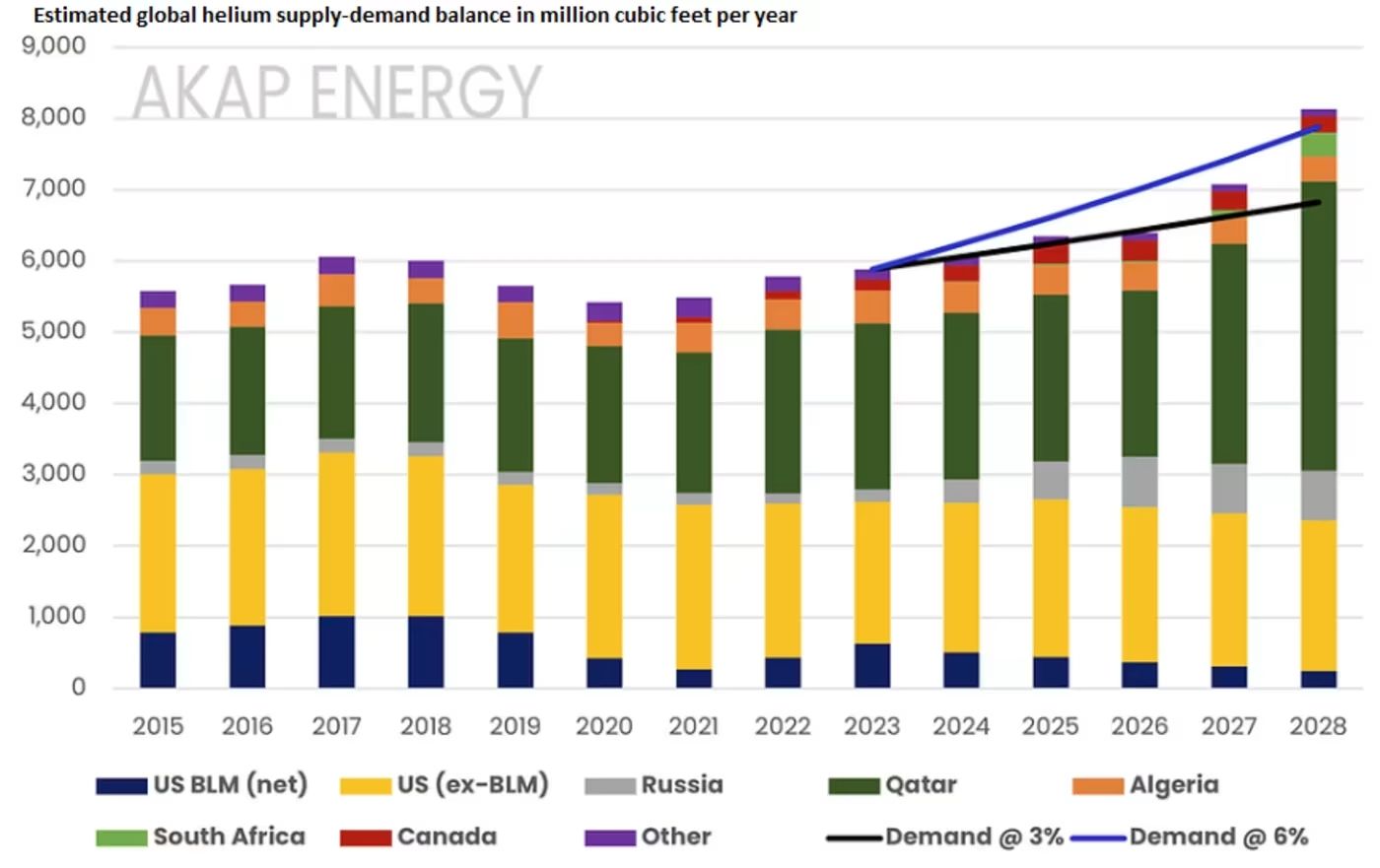

Given its unique properties, helium is a “critical irreplaceable commodity” for several industries, said Anish Kapadia, chief analytics officer at the Edelgas Group. “There has been an increasing undersupply of helium over the last decade, which has led to the growth in the number of companies exploring for helium to solve the shortage.”

The lack of adequate supplies to meet demand has made the recent sale of the U.S. helium reserve particularly worrisome. While helium is probably best known for its use in party balloons, it’s a critical component in scientific research, medical technology such as MRI scanners, national defense, airships, high-tech manufacturing and space exploration.

Earlier this month, the U.S. Department of Interior’s Bureau of Land Management, or BLM, which manages the Federal Helium System in the U.S., including a storage reservoir in Texas, announced that it accepted bids for the purchase of the system by privately held industrial gas firm Messer LLC. The sale of the reserve, which is not yet complete, had been previously mandated by the Helium Stewardship Act of 2013.

That helium production in the U.S. is in decline is no surprise given that all historical helium production was from conventional natural-gas production, which is also in decline, said Dean Nawata, manager of corporate development at Royal Helium Ltd. RHC, -2.94%.

U.S. dry natural-gas output totaled 37.9 trillion cubic feet in 2023, a record high based on government data going back to 1930, according to the Energy Information Administration.

However, most of the new U.S. natural-gas production is from shale, which “tends not to have helium,” said Nawata.

In Canada, helium is one of 31 federally designated “critical minerals.”

About one-third of the world’s helium supply is needed to run medical MRI equipment, said Nawata, adding that in Canada alone there are some 378 MRI machines.

Helium demand from “newer, high-growth sectors” such as rocket launching, high-tech manufacturing and small modular nuclear reactors continues to increase worldwide and, importantly, in North America, he said.

Helium discoveries

Helium is a chemical element that’s notoriously difficult to extract, given that its molecules, as the Encyclopædia Britannica explains, can wind up “on a one-way mission to space.”

The commodity has no substitute in many of its applications, and it’s found in “recoverable quantities in only a few locations around the world,” according to the BLM.

Canada has grown its production significantly over the last few years, said Edelgas Group’s Kapadia, who’s also founder of helium market-data service AKAP Energy.

There have been some “promising” discoveries, Kapadia said, in South Africa by natural-gas and helium producer Renergen Ltd. REN, 2.16%, in Tanzania by Noble Helium Ltd. NHE, +1.04% and Helium One Global Ltd. HE1, -1.52%, in Canada by North American Helium and Royal Helium, and in the U.S. by Pulsar Helium Inc. PLSR, 0.00% and Avanti Helium Corp. AVN, -1.23%.

In late February, Pulsar Helium’s chief executive officer, Thomas Abraham-James, told CBS News that his company’s helium discovery in Minnesota’s Iron Range could be one of the most significant such finds in the world.

Lack of transparency

The helium market has encountered production challenges over the years.

Some natural-gas fields where helium content was identified were not exploited because of the low helium prices back in the 1950s and 1960s, said Don Mosher, president and director at Desert Mountain Energy Corp. DME, 4.17%. But junior helium producers are now drilling into those old gas fields, since more recent prices for the commodity make these fields more attractive, he said.

Christopher Ecclestone, mining strategist at Hallgarten & Co., told MarketWatch that helium didn’t exist for junior producers, but now that market has opened up — and it’s a “bit of a last frontier.”

Desert Mountain Energy is focused on helium production and processing and, Mosher said, has plans to acquire more natural-gas fields with helium content.

Helium prices, however, are tough to track.

The commodity isn’t traded globally like copper HG00, 0.46% or gold GC00, 0.00% but purchased through individually negotiated contracts signed under nondisclosure agreements, said Mosher.

The nature of the helium market ‘results in a lack of transparency.’

— Don Mosher, Desert Mountain Energy Corp.

The “nature of the market results in a lack of transparency,” he said.

Mosher told MarketWatch that shortages of the commodity have driven prices higher by 800% since 2018.

Meanwhile, Royal Helium, which says it’s the first public helium company to produce, refine, and sell helium, publicly acknowledged two helium sale agreements. One sales agreement was at $450 per thousand cubic feet in 2022 and another was for $625 in 2023, both to a major North American space launch company. Some industry data show that prices were at around $100 until about 2012 and climbed up to $400 by 2021.

Pricing is “opaque and controlled by the 5 to 6 large gas distributors,” such as Air Products & Chemicals Inc. APD, 1.54% and Air Liquide S.A. AI, -0.45%, said Royal Helium’s Nawata.

Either way, the figures show significant increases in the value of helium just in the last few years.

Royal Helium intends to bring more wells, those that have already been drilled but have yet to be tested, into production with two more plants in the next 12 to 18 months, and it plans to continue drilling more fields “well into the future,” said Nawata.

Investing

As with production and price transparency, finding a way to invest in the helium sector has its own challenges.

Edelgas’s Kapadia estimated that there are around 20 listed helium stocks. But there are no related exchange-traded funds, said Hallgarten’s Ecclestone.

And keep in mind that big helium deposits are of “no interest” if the helium from those deposits can’t be transported, he said.

The commodity is known as the “great escape artist” because it must be transported in a totally hermetically sealed environment, Ecclestone said. “This dictates which deposits will be commercially viable.” Helium can also be turned into, and transported as, a liquid.

Exploration for, and development of, new, large helium deposits is critical for the medical industry, semiconductor manufacturing and rocket launches, said Nawata.

Given the demand-growth pattern, generally at a 6% compound annual growth rate, or CAGR, and at a more than 20% CAGR for semiconductors and rocket launches, Royal Helium believes the market will “continue to be in deficit and perform well for years to come,” Nawata said.

“There is a great ongoing need for helium, not only worldwide, but specifically for the western world,” he said.

Copyright © 2024 MarketWatch, Inc. All rights reserved.