Carbon offsets are under intense scrutiny, with recent reports from Amazon to Australia exposing some flaws, which may lead to doubts about their effectiveness and, therefore, distrust. This is made worse by the fact that understanding this whole system- carbon offsets, removal, or avoidance- can be complicated. Think of it as trying to solve a complicated puzzle where various players, including experts, are figuring out how different pieces fit together best. Even with all these difficulties, it's hard to ignore that the voluntary carbon market is expected to grow from 2 billion in 2020 to as much as $200 billion by 2030-40, according to one estimate. Therefore, restoring the trust of investors, governments, and the general public in this market is essential.

While it is often the problematic areas that make the headlines, it is essential to note that there are several good things about carbon offsets; most notably, they offer an indispensable solution to help us meet climate targets when other efforts to reduce emissions fall short. Undeniably, constructive criticism is essential for growth. Yet, it is also important to recognize the complexities of this nascent market that is evolving rapidly and has teething issues. Leaning on the classic adage to bring home the critical point. Was Rome built in a day?

There is thus a need to resurrect the trust in carbon offsets, away from this attention skewed to adverse outcomes. The unintended consequence of such skewed attention is that it fuels concerns, making key stakeholders skeptical about venturing into this critical space. It also disadvantages organizations that sell genuine, high-quality carbon offsets. And that's a big problem because these offsets play an integral role in keeping global warming under control. Therefore, it is essential to re-emphasize some of the basics of carbon offsets, to enhance their effective contribution toward meeting global net-zero targets.

What Kind Of Carbon Offsets Align To Net Zero

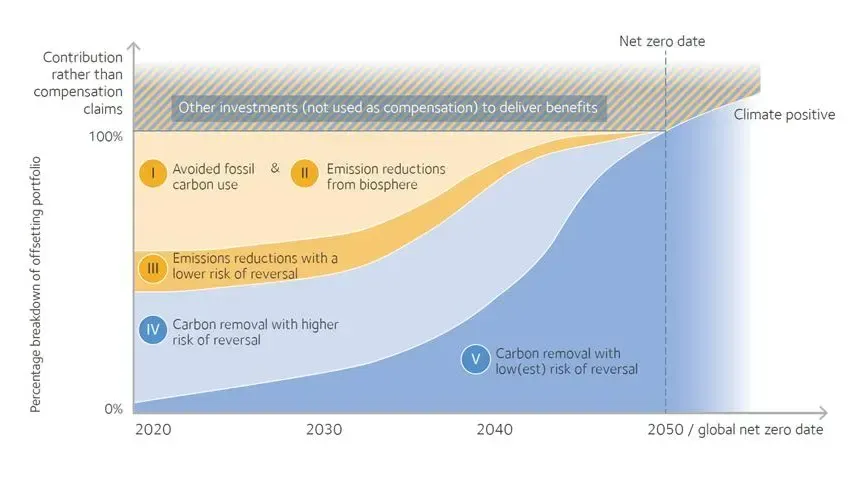

For newcomers, there are two offsets: removal and reduction/avoidance. Both help reach net zero, but their importance changes over time. Both need more investment now. Organizations can create a portfolio of both these offsets for their net-zero strategies. However, all offsets are recommended only for beyond-value-chain mitigation when efforts to remove residual emissions within the value chain run out.

Offsets from carbon reduction—reduce or avoid carbon through measures such as renewable energy, energy efficiency or avoided ecosystem loss degradation—are essential now, but they can be expected to wane over time. This trajectory is presented in a simple chart in the Oxford Principles for Net Zero Aligned Carbon Offsetting released last month. The gradual waning out is understandable. For instance, carbon reduction or avoidance offsets through clean cooking programs are instrumental in reducing emissions and bringing co-benefits of better health and incomes to some of the poorest parts of the world. Over time, as energy access improves through clean cook projects, the scope of further expansion would reduce.

Carbon removal offsets are tools that remove and store carbon. They're expected to become much more critical in the long run. These offsets fall into two categories: removal from the biosphere and removal from the geosphere. Biosphere removals happen in various ways, like planting trees or restoring ecosystems. But there's a risk that the stored carbon could be released back into the atmosphere, such as if the forest is destroyed or catches fire later on. Like reduction offsets, these offsets may also phase out over time because there's only so much land available for forests and ecosystems on our planet.

Removals from the geosphere happen through technology such as Direct Air Capture and Storage, which capture and store carbon from the atmosphere. For example, oil companies are increasingly investing in carbon capture and directing stored carbon pressure to extract oil from rocks.

Carbon removal from the geosphere is identified as a significant opportunity for investment but remains lagging due to high costs. Only some oil companies and big tech companies are currently dominating this space. According to the Berkeley Carbon Trading Project's Voluntary Offsets Database, only 3% of carbon offset projects have gone to pure carbon removal.

How Much Carbon Removal Is Needed For Net Zero

The world needs carbon removals roughly in the range of 5 to 15 gigatons of CO2 equivalent per year between 2030 and 2050. These estimates are based on pathways used by IPCC, the scientific body guiding global net zero efforts. This amount is roughly equivalent to the annual emissions of the United States, the top producer, and it is no small task to remove this amount of CO2 from the atmosphere.

It's important to understand that the above range of numbers show it's hard to know the exact amount of carbon removal needed. The numbers are based on hypothetical scenarios that rely on efforts made now. For example, the need for carbon removals is low in scenarios where renewable targets are achieved, but it's much higher in other scenarios focused on harmful emissions.

Preparing for all outcomes is essential; therefore, carbon offsets are significant. In this Easter season, as people worldwide reflect on the resurrection, the word 'resurrect' may not immediately conjure thoughts of carbon markets. However, its essence resonates deeply in this phase of skepticism, emphasizing the critical need for trust in this vital domain.

© 2024 Forbes Media LLC